Overview

The CLC is a pure regulator; we do not have a representative function. All our income is generated from the regulated community and is utilised in the performance of our regulatory obligations.

At 31 December 2023, the CLC regulated 203 practices (2022: 222).

At the end of December, the CLC had 1,825 (2022: 1,638) active CLC lawyers (Licensed Conveyancers and Licensed Probate Practitioners) on the register.

Budget and billing arrangements

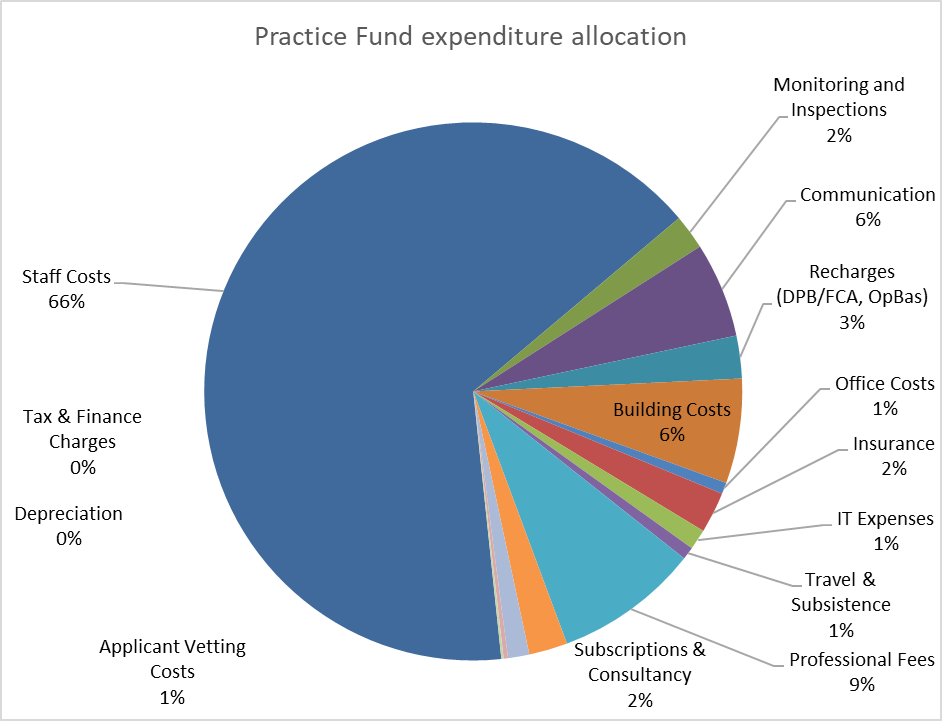

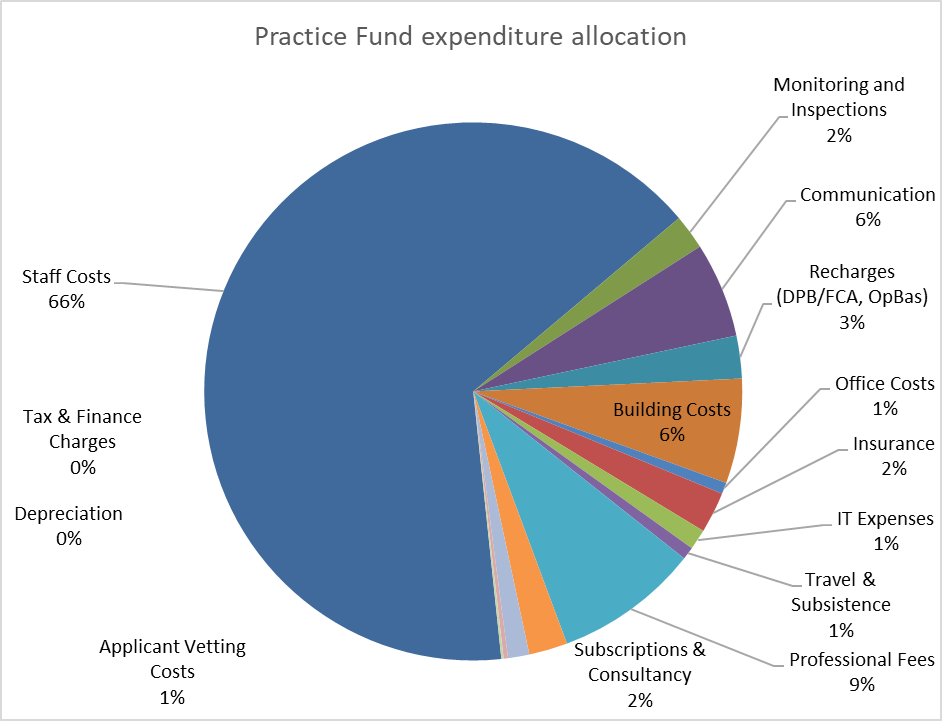

The CLC has worked hard to keep the regulatory burden on practices as low as possible. Since 2016 we have reduced Practice Fees by over 60%. During the pandemic and ensuing economic crisis we were able to keep fee rates steady by utilising reserves and running a deficit budget. The excess reserves that we held have now been fully utilised and this has necessitated that we run a surplus budget from 2023 to ensure that we maintain an appropriate level of reserve. This means that we must increase the Practice Fee rates by 10% this year to ensure we can deliver our regulatory objectives.

The Council decision to increase Practice Fee rates was based on the following factors:

- A 4% reduction in aggregate practice turnovers declared by practices which would translate into an automatic reduction in income to fund regulatory activity if no action were take;

- Increased cost, particularly staff costs, due to the rate of inflation that is affecting all organisations;

- The need to recruit additional staff to ensure we are able to deliver our regulatory responsibilities effectively;

- The need to maintain an appropriate level of reserves.

- The results of the Fee consultation.

Although we are increasing the Practice Fee rates, we are not making any changes to Individual License Fees, The Compensation Fund contribution or the OLC levy allocation between usage and availability charges.

The Fee rate proposals were subject to an open consultation over the summer. The Legal Services Board approved the Practice Fee application on 3 November 2023. You can find a copy of the application and the approval here.

All practices are required to pay the Practice Fee, OLC Levy and Compensation Fund Contribution as a condition of licence. These Fees are levied on Practices annually for the licensing year starting on 1 November. All practices have the option to pay in 12 monthly, interest fee payments, payable by direct debit. Please note that all regulatory fees are due on invoice. Any practice that takes advantage of the instalment payment option and decides to close during the Licensing year, will be required to pay the balance outstanding on notification.

CLC excess reserve levels have now been fully depleted. The reduction of reserves was achieved through Fee rate reductions and running a deficit budget. Since 2023 the CLC has run a surplus budget to maintain remaining reserves and create additional reserves for the funding of the OLC Levy. The OLC charges to the CLC have increased annually well in excess above the rate of inflation.

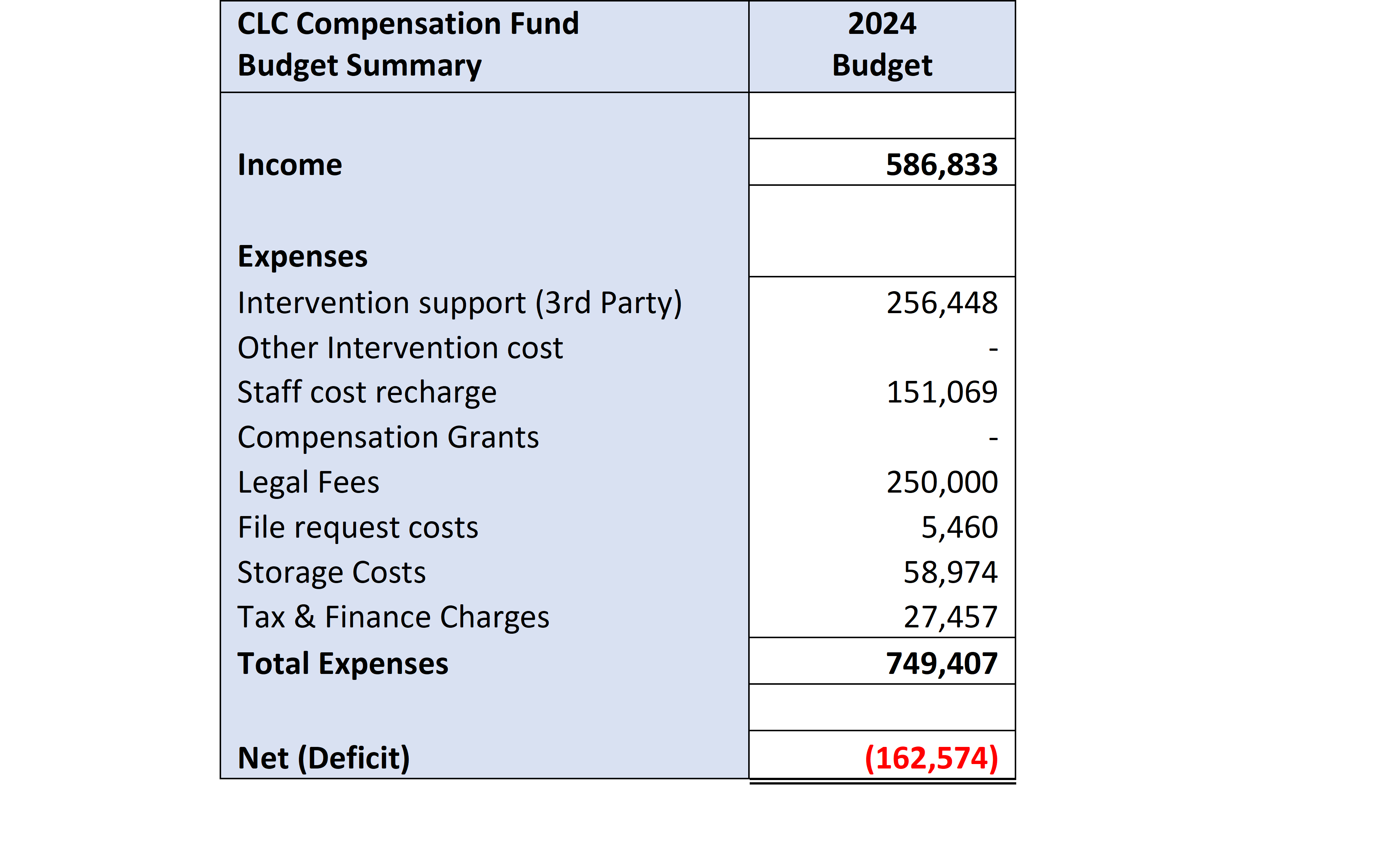

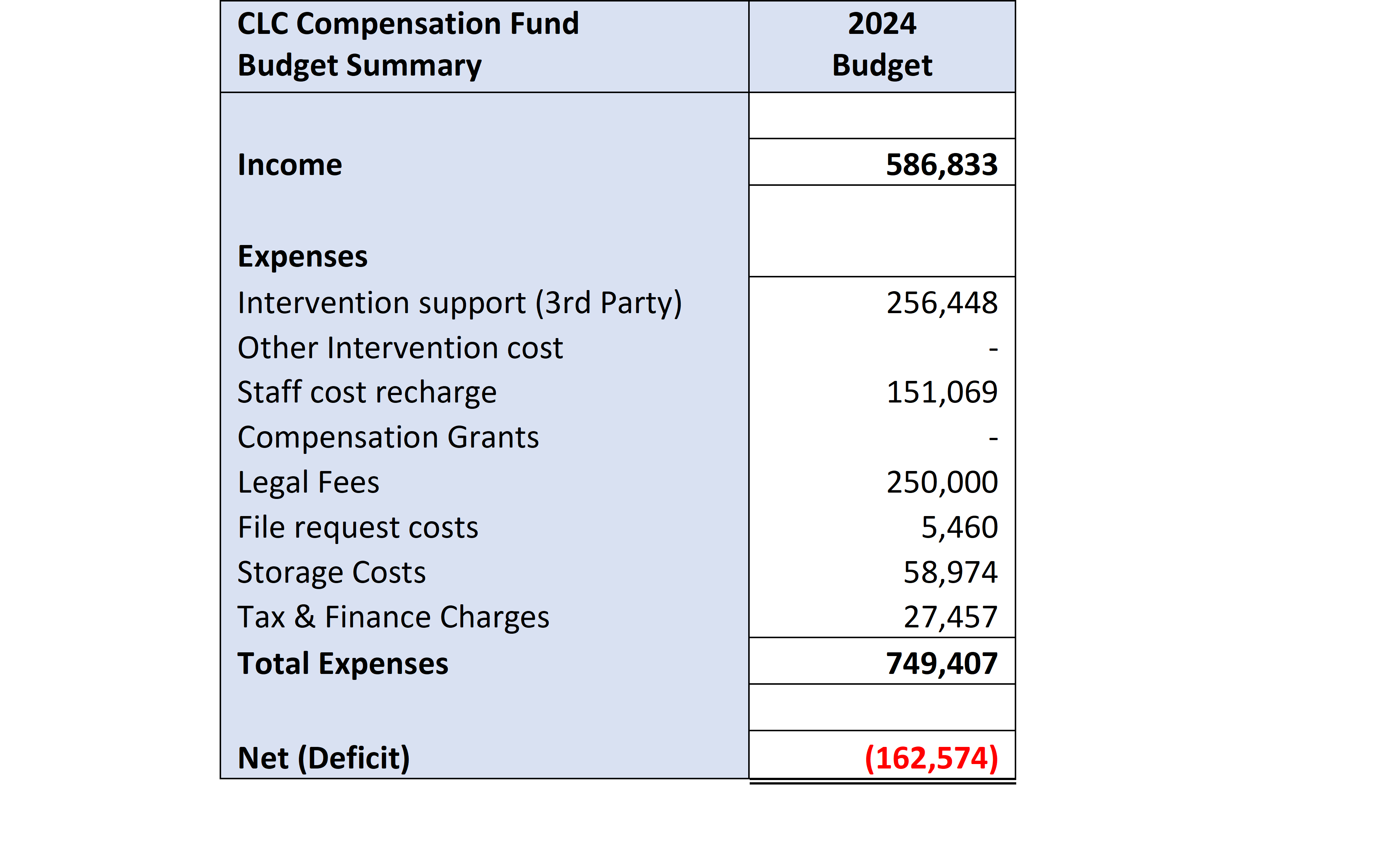

CLC Compensation Fund cost estimate for 2024

The Compensation Fund Expenditure and your contributions are ring fenced and used only for:

- Intervention and practice closure related expenditure (this includes costs associated with finalisation of client matters and storage of files)

- Compensation Fund Grant payments (this includes the payment of grants and, where appropriate, legal fees associated to claims made).

The estimated Income and expenditure are included in the table below.

We do not budget for Compensation Fund grants or new intervention related cost. This is done because we are not able to accurately estimate the timing or value of such expenditure. We ordinarily run a surplus budget which is usually sufficient to offset the payment of Compensation Grants and intervention costs. Due to ongoing intervention related costs (from interventions in 2023) we expect higher that usual expenditure and anticipate running a deficit budget. The deficit will be funded from accumulated reserves. The Fund is current fully reserved (£8,4m).

The expenditure estimates for 2024 includes:

- Intervention Support costs paid to 3rd parties who act as intervention agents for the CLC after intervening in a practice.

- Ongoing intervention costs (the cost of file storage, administration of file request and legal costs to support clients of closed practices)

- Recharges (the cost of staff that administer and maintain the Fund)

- Legal costs (cost associated with the defence of claims and protection of the Fund)

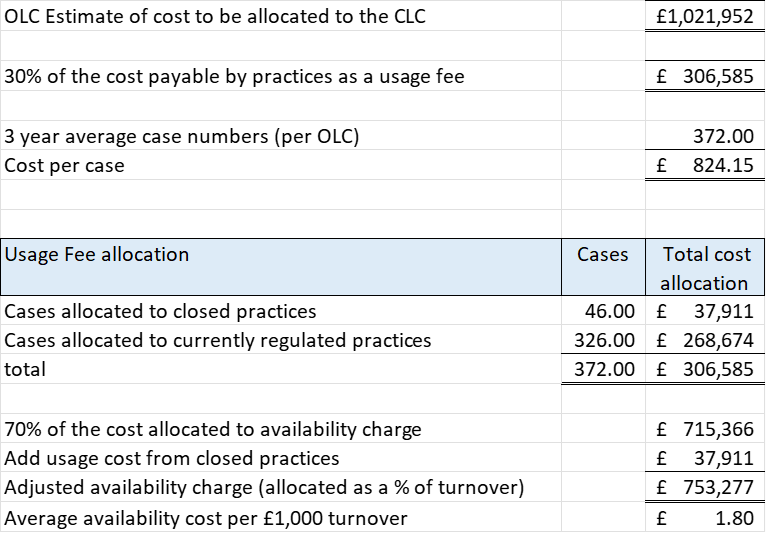

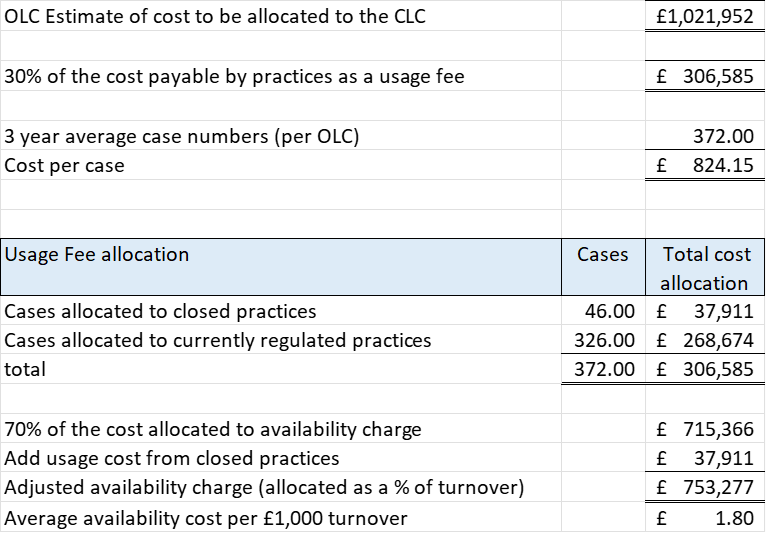

OLC Levy calculation

The Legal Ombudsman costs are allocated to approved regulator (and by extension the regulated community) in accordance with the Legal Services Act 2007 (Levy) (No.2) (Amendment) Rules 2014.

The payment of the OLC costs was separated from the Practice Fee in 2021 and an “OLC levy” was implemented from November 2021.

The legal Ombudsman allocates their cost proportionately to regulators using the 3-year average number of cases accepted by the ombudsman. The CLC then allocates 70% of the total cost to all practices proportionately based on turnover. The remaining 30% of the cost is allocated to practices using the case numbers provided by and used in the Ombudsman’s cost allocation. We think that this is the fairest method of allocating the usage cost as it is these case numbers that drive the overall cost.

The CLC is of the view that these costs are excessive and that the method of cost allocation to the regulators is not transparent or fair as the cost of the other activities from which the legal sector as a whole benefit are not being allocated.

Costs for individual practices

Letters setting out more detail of this were sent to individual practices in November 2023. If there is any further information or clarification you would like, please write to clc@clc-uk.org and we will be pleased to help.