TRANSFORMING HOME BUYING AND SELLING

There has been a great deal of activity in the last quarter. Key events were the Digital Property Market Steering Group (DPMSG) conference in September and the CLC’s annual roundtable later in the same month. Those roundtables build on the CLC’s 2020 discussion paper Conveyancing 2023.

DPMSG members are developing the next steps following the conference, which showed that there is real support for transformational change across the sector. The report on the CLC’s roundtable will be published soon and the report of last year’s edition is available on the CLC’s website.

We’ve also seen great adoption of technology and new working practices amongst our regulated community. For example, 94% of CLC-regulated practices are using electronic ID and verification tools for new clients, ensuring they are delivering secure and efficient services.

Practices trialling upfront information report very significantly reduced transaction times, for example. National Trading Standards is working hard to implement the new requirements for estate agents to provide all the necessary Material Information at the point of marketing a property. On a different front, proposed new digital identity trust framework that is being piloted for the conveyancing market will be able to be implemented under legislation the government is bringing in to make the provision of ID simpler and faster across the whole economy.

Government involvement

The Department for Levelling-Up, Housing and Communities is showing renewed interest in this work. Officials there are now in frequent and close contact with the key stakeholders. Officials have been clear that there is no scope for legislation to mandate any changes and that ministers are looking to the sector to deliver innovation. This is part of the challenge, because change will require several players (estate agents, lenders, conveyancers, IT suppliers, representative bodies of lawyers and to a lesser extent regulators) to make changes in coordination.

The kinds of changes that will deliver the transformation that is both possible and very desirable will be disruptive to the industry as it exists at the moment. The CLC believes that ministers will need to play a role in driving that change through encouragement and warning.

The challenge for the sector now, and one that the DPMSG, working with the much wider Home Buying and Selling Group is committed to tackling, is to speed up adoption of the many new tools and approaches that can genuinely transform the home buying and selling process. It is possible to deliver faster, better, simpler and more certain conveyancing transactions without changes to the legislation governing the conveyancing process.

ECONOMIC OUTLOOK

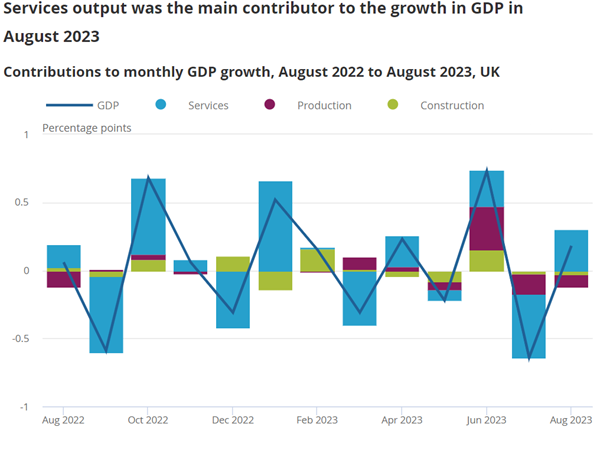

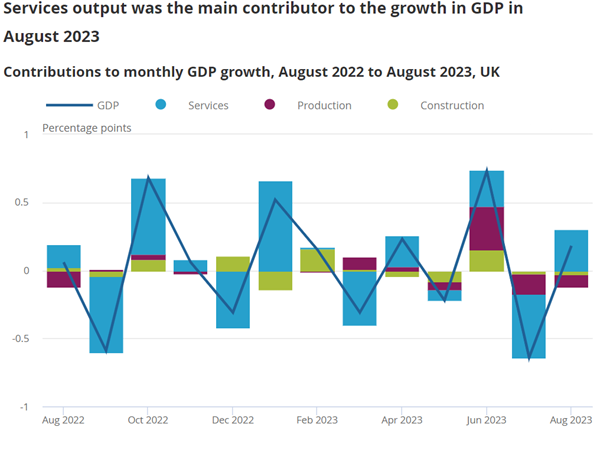

The most recent report by the Office for National Statistics (ONS) on Gross Domestic Product (GDP) found that GDP grew by 0.2% in August compared with a 0.6% fall in July. As the chart below shows, the economy’s performance is erratic.

In September, KPMG issued its UK Economic Outlook report, saying that ‘the UK economy is experiencing renewed signs of stress. While worries about a deep recession have largely gone away, the prospects of high interest rates and low productivity are expected to hold back growth.’ KPMG forecasts that growth will slow to 0.4% in 2023 and 0.3% in 2024. In their opinion, ‘uncertainty around the upcoming general election and strength of demand suggests that risks are skewed to the downside.’

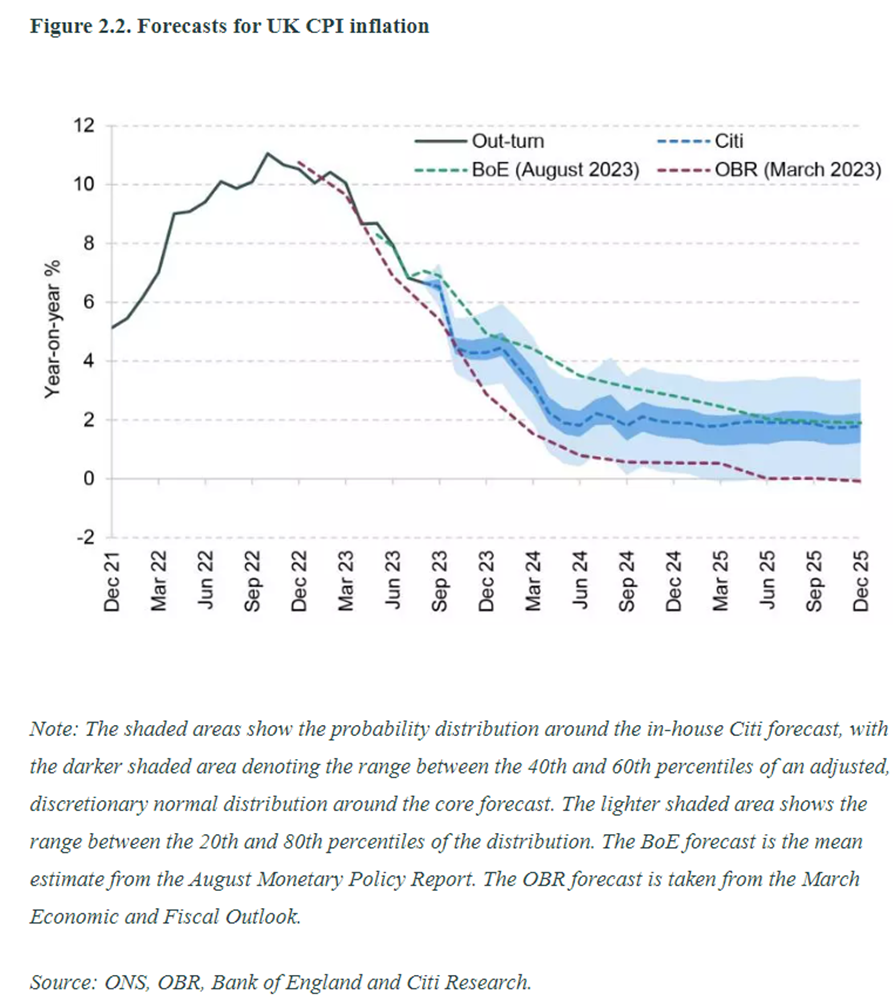

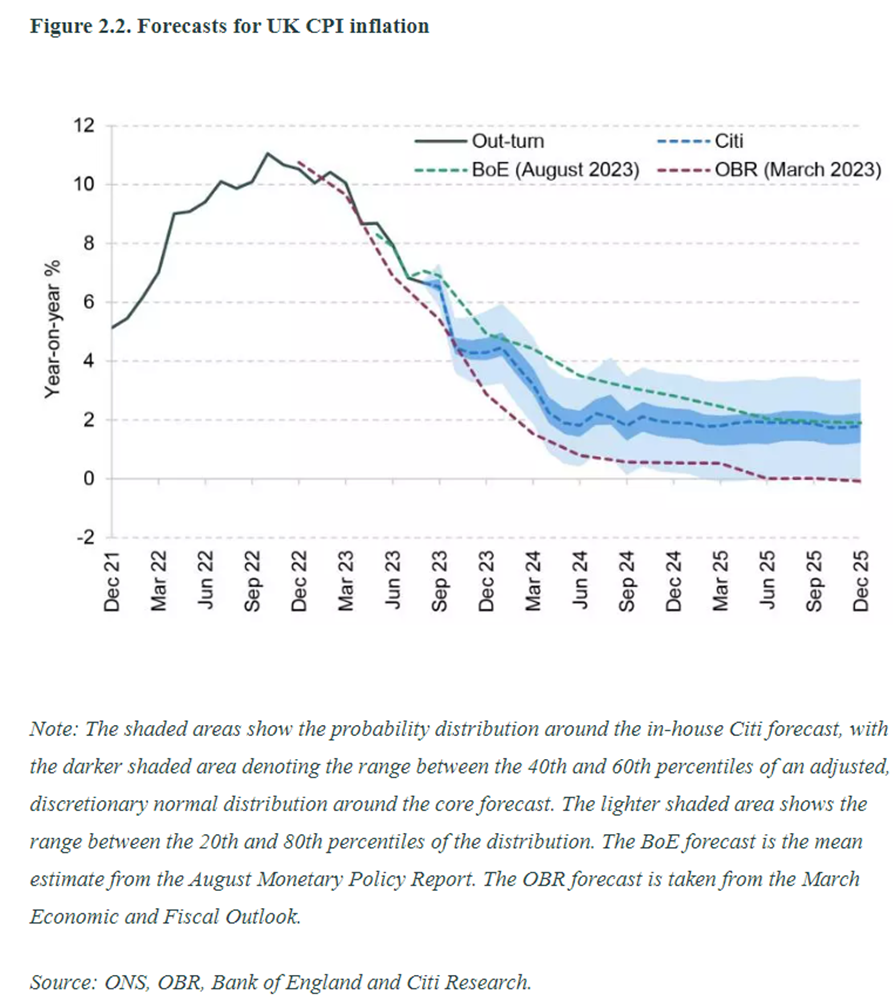

The Institute for Fiscal Studies produced a useful graph (below) bringing together a range of projections for inflation which suggests that inflation may return to the Bank of England’s 2% target in mid-2024.

Consumer Confidence

These expectations may be feeding into consumer confidence, which in October fell back, losing the gains that had built up over August and September, according to GfK’s most recent report.

Their Client Strategy Director observed:

This sharp fall underlines that the cost-of-living crisis, and simply not having enough money to make-ends-meet, are still exerting acute pressure for many consumers. The fierce headwinds of meeting the accelerating costs of heating our homes, filling our petrol tanks, coping with surging mortgage and rental rates, a slowing jobs market and now the uncertainties posed by conflict in the Middle East, are all contributing to this growing unease. The timing of the sharp drop in our major purchase measure – down 14 points – will concern retailers across the land in the run-up to Christmas. The volatility we are seeing in consumer confidence is a sure sign of a depressed economic mood and there’s no immediate prospect of any improvement.”

HOUSING MARKET

The most recent RICS Residential Market Survey, published in early October, found that ‘indicators on demand, sales, instructions and prices all remain in negative territory’ and that ‘near-term outlook still downbeat although twelve-month sales expectations are now stable’.

ONS has reported on house sale prices in the twelve months to August 2023.

- Average UK house prices increased by 0.2% in the 12 months to August 2023 (provisional estimate), down from 0.7% (revised estimate) in July 2023.

- The average UK house price was £291,000 in August 2023, which was little changed from 12 months ago, but £9,000 above the recent low point in March 2023.

- Average house prices over the 12 months to August 2023 remained little changed in England at £310,000 (0.0%) and decreased in Wales to £217,000 (negative 0.1%)

HMRC has reported on the numbers of transactions in August 2023:

- the provisional non-seasonally adjusted estimate of the number of UK residential transactions in August 2023 is 95,000, 16% lower than August 2022 and 11% higher than July 2023

- the provisional seasonally adjusted estimate of the number of UK residential transactions in August 2023 is 87,010, 16% lower than August 2022 and 1% higher than July 2023

- the provisional non-seasonally adjusted estimate of the number of UK non-residential transactions in August 2023 is 9,720, 3% lower than August 2022 and 8% higher than July 2023